The 2021 ASNP Virtual National Meeting

The Academy of Special Needs Planners

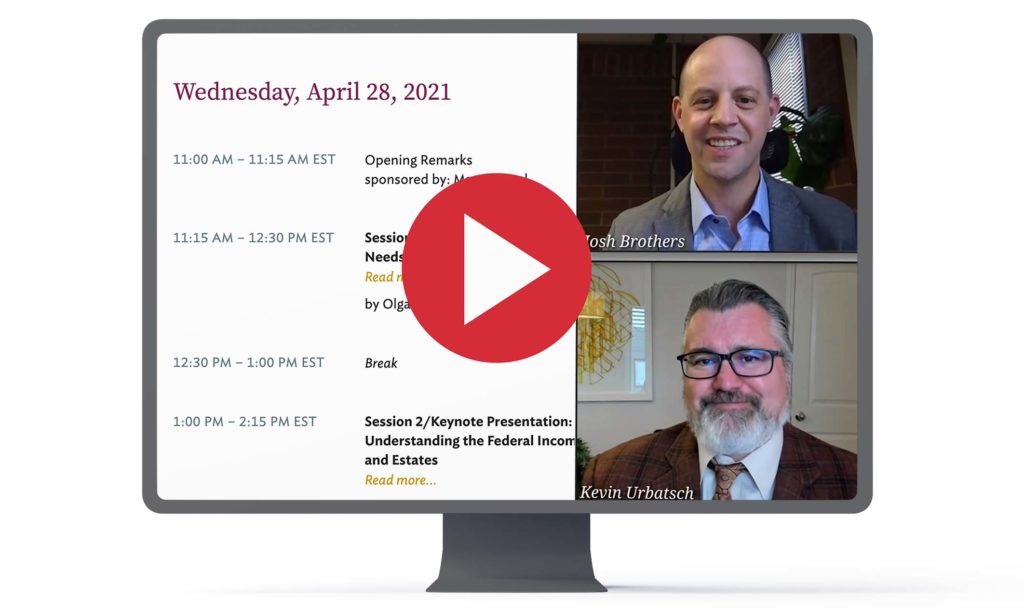

SESSION VIDEOS • NOW AVAILABLE

ASNP National Meeting

Continuing the Journey

The 2021 ASNP Virtual National Meeting will be the 15th consecutive annual meeting of the Academy of Special Needs Planners.

This year’s virtual meeting will build on our highly successful 2020 virtual meeting. It will continue the gathering’s core mission: to bring together professionals from key disciplines to share knowledge and strengthen the greater special needs community.

2021 Keynote speaker

Sam Donaldson, Professor of Law, GSU

Fifty Shades of J: Understanding the Federal Income Taxation of Trusts and Estates

This presentation covers what special needs planners need to know about the federal income taxation of estates and trusts, with an emphasis on recent developments and the common mistakes and traps in the field. Also included is brief discussion of post-SECURE Act retirement planning.

- Who should attend?

Novice or experienced professionals in key special needs planning disciplines: Law, Financial Planning, Trust Administration and Academics.

- What you’ll bring back to your practice:

A deeper understanding of the planning principles and strategies that will enhance the services you provide your special needs clients: SNTs, Savings Plans, Public Benefits, Funding and Tax Strategies.

- Connect with your colleagues.

Participate in virtual discussions with colleagues from around the country as well as nationally recognized leaders in special needs planning via desktop and mobile.

2021 Virtual Meeting on April 26-30, 2021

Check out the agenda and learn more about our esteemed speakers.

Pre-Session Programs

For Attorneys:

Understanding the fundamentals of Supplemental Security Income (SSI), Social Security Disability Insurance (SSDI), Childhood Disabled Beneficiary Benefits (CDB), Medicaid, and Medicare is the critical first step for the professional to know how to properly plan for persons with disabilities and how to manage their personal and financial care during their lifetimes. This is the foundational program to all other programs. It is a must see for the beginner and an excellent refresher for the experienced professional. Learn More

This discussion will provide an overview of the information needed to prepare the estate plan, suggestions on the proper way to implement the plan, the use of memorandums of intent, and an introduction to the third-party special needs trust. Learn More

This session will be a “behind the scenes” look at the administration of SNTs from a Trustee’s perspective and the balancing act of administering Special Needs accounts – the intersection of SNT rules and the Fiduciary standard. Neil will provide examples of where a SNT 1st or 3rd trusts and larger fiduciary drivers like duty of loyalty meet and match up and where they conflict. Learn More

The session will provide a basic overview of the unique issues that arise at the time of a settlement or other recovery when Plaintiff is on public benefits, including subrogations and liens, first party special needs trusts, spend downs, ABLE Accounts, Medicare set asides (MSAs), structured settlement annuities, and qualified settlement funds (QSFs). You will learn the tools you need to properly advise personal injury attorneys and their clients on how to manage a recovery. Learn More

A panel of speakers will discuss real world examples of how to implement the settlement planning strategies learned in the prior session. Learn More

For Financial Advisors:

We will explore costs and resources, government benefits, SSI, SSDI, Adult Child Benefits, Medicaid and Waivers. The impact of employment, earned/total income and assets will be considered. We’ll review ABLE accounts with Tax Cuts and Jobs Act of 2017 updates, First and Third Party SNTs, Pooled, Miller and Qualified Disability Trusts. Funding strategies, including Life & Long Term Care insurance, investments and qualified assets with Secure Act updates. Learn More

In this session, you will learn about recently issued ABLE account IRS regulations, how they will impact use of ABLE accounts and how they will impact administration of ABLE Accounts. You will also be updated on recent developments in the use of ABLE accounts nationwide and creative uses of

ABLE accounts. Learn More

Professionals planning for parents caring for those with special needs are often unaware of possible tax benefits and frequently forgo hundreds, if not thousands, of dollars in potential tax deductions and credits. Among these potential tax benefits that we will address include deductions or credits for the dependency exemption, medical expenses, special instruction, capital expenditures for medially required home improvements, impairment-related word expenditures, and the adoption tax credit. Learn More